Process in Action

- Our research focus helps clients make

- sense of an ever-changing energy landscape.

BUILDING A PROCESS THAT WORKS THROUGHOUT THE ENERGY CYCLE

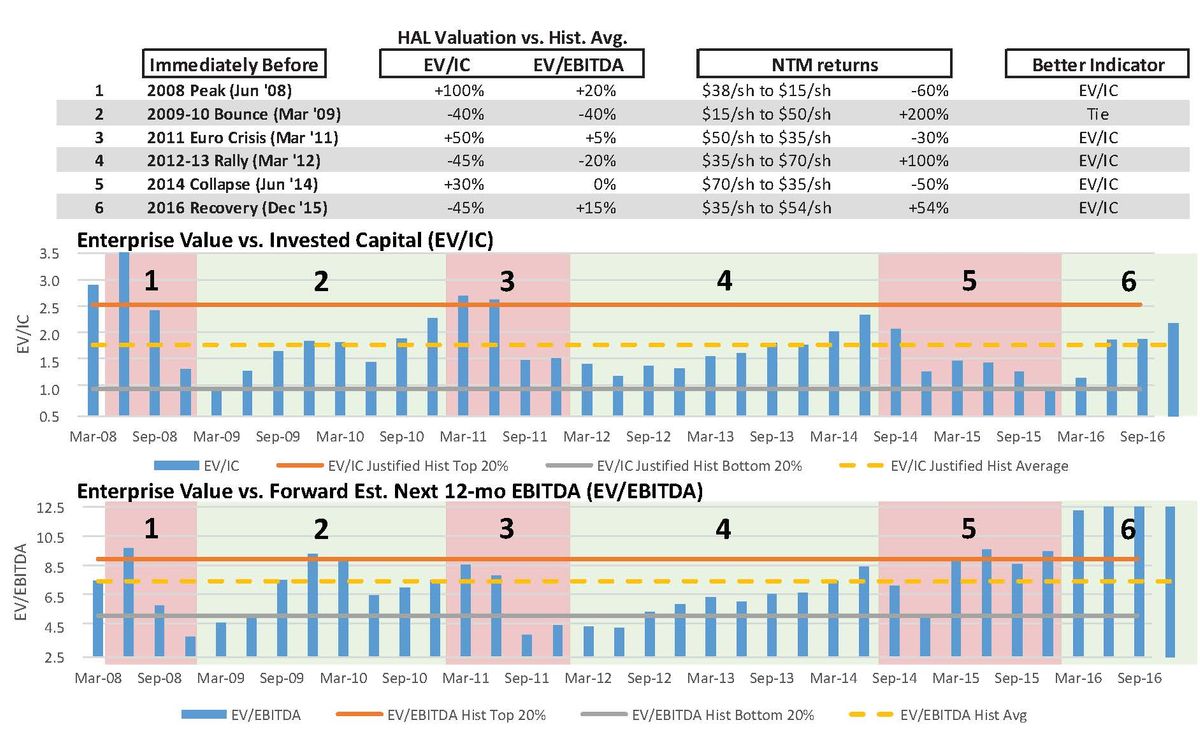

A disproportionate share of energy returns are made or lost when cycles change. A successful investing framework must work even when cycles are at their most volatile, even for a cyclical business like Halliburton (shown below).

EV/IC vs. EV/EBITDA through the cycles: Halliburton

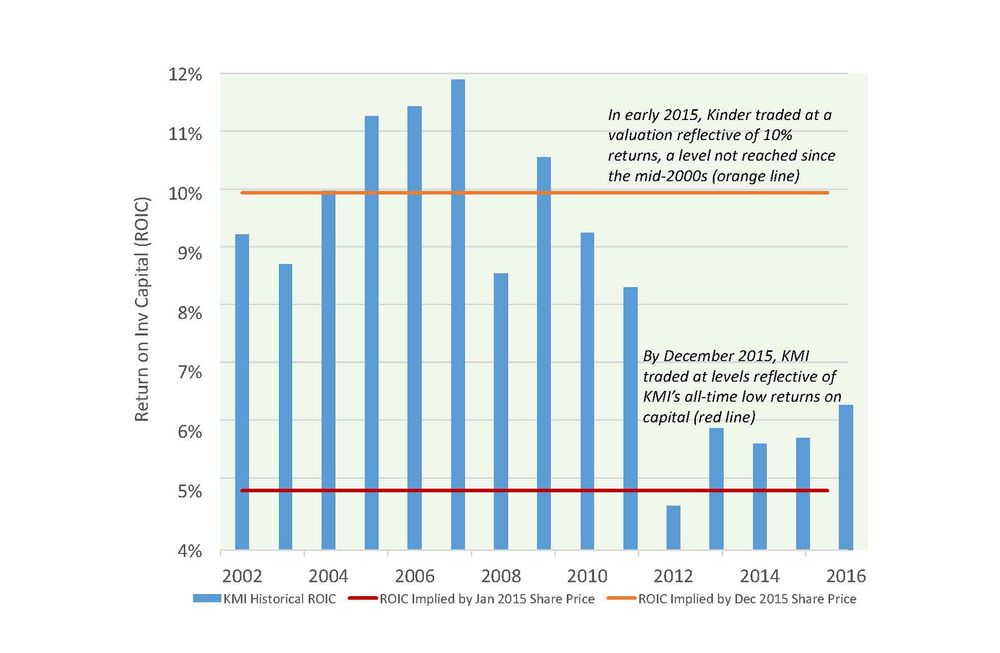

HOW THE PROCESS WORKS: KMI, LATE 2015

In a cyclical industry, sell-side reports and investor sentiments follow the commodity price, so a well-honed counter-cyclical methodology is key.

- Unlike P/E and EV/EBITDA, EV/IC can offer a valuation target based on a company’s performance as an asset allocator, independent of the current oil/gas price environment

- In late 2015, market darling Kinder Morgan cut its dividend, leading to a sharp re-rating in KMI’s equity valuation

- In reality, KMI’s average returns (ROIC) had been declining for years, reflective of deteriorating capital allocation and costly M&A

- While the market abandoned KMI, Recurrent’s principals used the dividend cut to initiate a position, as the EV/IC multiple reflected market expectations of perpetual 5% ROIC