Recurrent Natural Resources Strategy

Comprised of investments in a broad array of natural resource-intensive industries, Recurrent's Natural Resources Strategy is managed to protect against inflation and generate strong relative and absolute performance in a variety of commodity environments.

Our Natural Resources strategies are available in Separately Managed Accounts (SMAs) for US investors, as well as our Alma Recurrent Fund for non-US investors.

We believe that the emergence of North American shale has shortened boom and bust cycles, and increased natural resources investors’ need for liquid strategies and flexible investment mandates.

The Recurrent Natural Resources Strategy’s investment mandate enables investment in producers as well as consumers of oil and gas, plus industry participants in between. With the ability to invest in companies that produce and consume natural resources, energy and other commodities, we believe the Natural Resources Strategy can offer differentiated performance in a variety of commodity environments.

A PROCESS FOR ANY COMMODITY ENVIRONMENT

At Recurrent, we invest by using commodity price as an output of – rather than an input to – our process. We believe that basing decisions on commodity forecasts, which often assume rising prices, can lead to inferior investment decisions.

We believe that company valuations can be used to derive market expectations of company-level returns (see more in “How We Invest”). Those company-level returns are based on implied future commodity prices. In effect, every company that produces, consumes, or services the energy industry has a valuation that implies a commodity price forecast.

At any given time, the various sectors that touch natural resources – metals and mining, agriculture, paper and forest products, exploration and production, services, midstream, refining, chemicals, industrials and others – all imply commodity prices that are often significantly different from one another.

By understanding which sectors and which companies imply the most attractively-priced oil barrels and cubic feet of gas, we create a framework for success regardless of where the underlying commodity is headed.

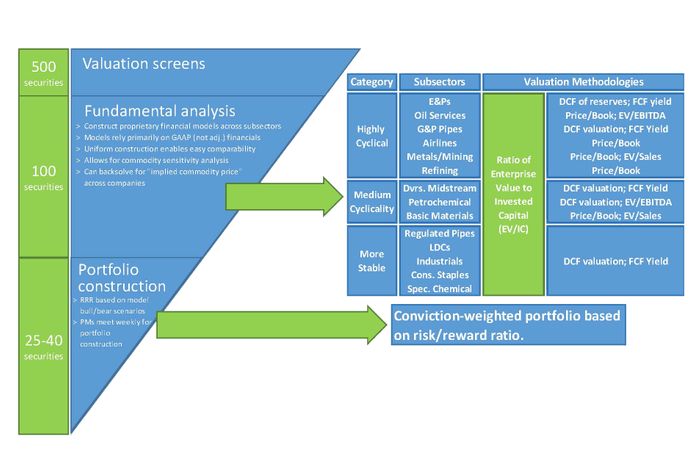

DIGGING FOR INVESTMENT OPPORTUNITIES

We screen several hundred companies across the industry, from resource producers to consumers, and whittle them down to roughly 100 using a variety of financial metrics, including Price to Book (P/B), Price to Earnings (P/E), and Enterprise value to earnings before interest, taxes, and D&A (EV/EBITDA).

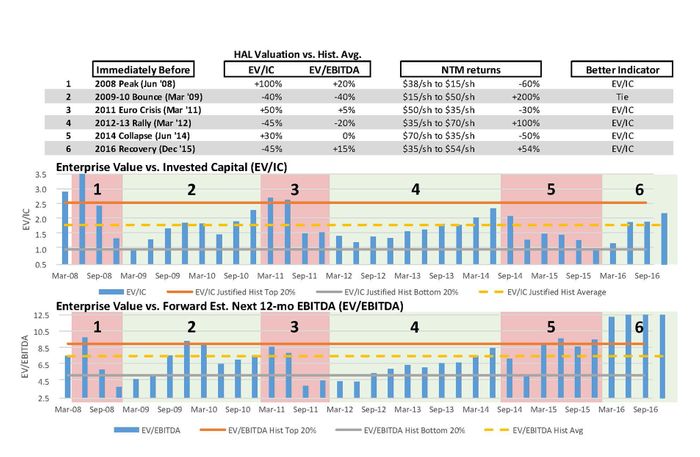

One valuation methodology we use extensively compares a company’s return-on-invested-capital (ROIC) to the cost of capital (WACC). This valuation methodology informs us of how effectively companies compound the value of their invested capital. More specifically, the relationship between a company’s ROIC and WACC should correspond to the relationship between a company’s Enterprise Value and Invested Capital (EV/IC).

We focus especially on EV/IC because we believe that it has unique, non-cyclical properties. Neither EV nor IC is significantly influenced by commodity-driven earnings fluctuations, while earnings and cash flows used in multiple analyses are typically market-to-market based on commodity price changes.

CONSTRUCTING A PORTFOLIO

We pass all investment decisions through a rigorous, value-oriented, bottom-up analysis. As we complete our valuation analysis, we determine the upside, downside and base cases and rank the stocks by the upside vs downside opportunity. Those stocks ranking in the top quartile become buy candidates whereas those in the bottom two quartiles become sell candidates. We formally review the portfolio of 25-40 companies in the Natural Resources Strategy and 20-35 in the MLP & Infrastructure Strategy at weekly investment meetings.

REPEATABLE INVESTMENT PROCESS

Valuations based on full-cycle returns on capital (EV/IC) can identify “exit points” at cyclical peaks and “entry points” at cyclical troughs…

...Cash flow/EPS multiples are inherently pro-cyclical, amplifying volatility

EV/IC allows us to “backsolve” for implied commodity pricing and expected future returns, implied by current valuations…

...Cash flow multiples obscure the commodity prices implied in valuations

EV/IC vs. EV/EBITDA through the cycles: Halliburton